How Extreme was Recent Large Growth Outperformance?

4/17/2025 - By Wes Crill, PhD, Senior Client Solutions Director and Vice President (Dimensional Fund Advisors)

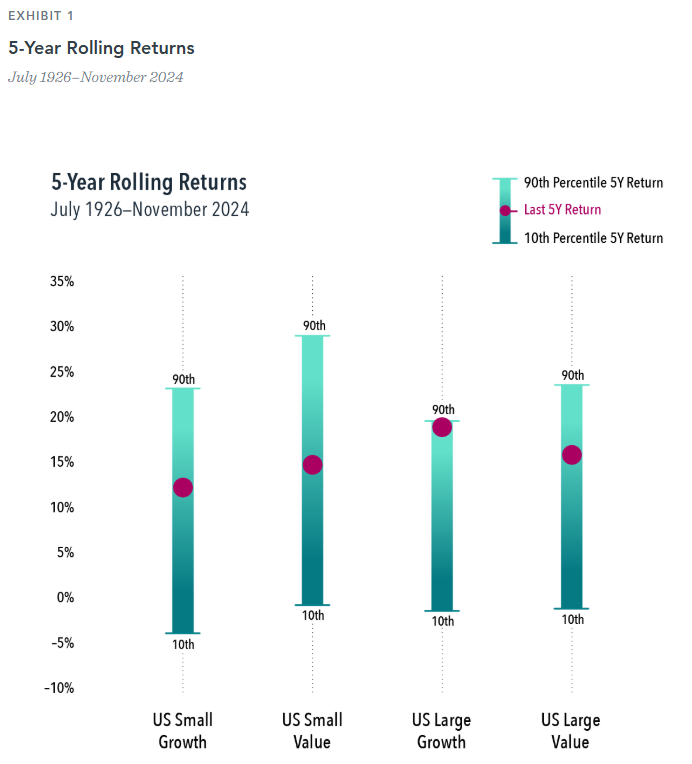

US small value stocks underperformed large growth stocks by about 4.5% per year over the past five years. Some investors have asked what went wrong with small value to garner such underperformance. Looking at returns over this period compared to the long term, we see the story is more about what went anomalously right for large growth.

Small value’s five-year number was squarely in the middle of its historical range of outcomes for rolling five-year returns, which span from –1.1% at the 10th percentile to 28.8% at the 90th percentile. Small growth and large value were both similarly far from their extremes over the past five years. Large growth, on the other hand, bumped up against its 90th percentile outcome of 19.6%.

It’s not clear that recent performance for value versus growth is helpful in predicting the future. A historically good run for growth doesn’t imply these stocks will come back to earth. But investors concerned about small value’s recent relative returns should be aware of which asset class outkicked its coverage over this stretch, while still enjoying the boost in return it provided to the overall market.

Related Posts

- How Extreme was Recent Large Growth Outperformance?

- Tariff Trepidation

- Alphabet Soup of Estate Planning

- It's More Than 'Just a Phase'

- How to Avoid Black Swans

- An Investing Plan for This Year

- Demystifying Personal Injury Settlements: A Guide to Navigating Your Claim

- Reality Check: Capital Market Assumptions vs. Actual Returns

- The Power of Human Ingenuity

- 2024 Year in Review

- Feeling Generous? Secure Your Own Financial Well-Being First!

- Election Years & Their Impact on the Market: A Data-Driven Perspective

- The Unwinding of the Yen "Carry" Trade

- Preventing Identity Theft: Tips to Protect Yourself & Your Family

- Saltmarsh Financial Advisors Recognized as Top Wealth Advisory Firm by Accounting Today

- Father's Day: Money Lessons Learned From Dad

- What is Dollar Cost Averaging?

- Cost of Capital: A Gut Check on High-Flying Stock Returns

- A Closer Look at Today's Inflation (2024 Edition): Not Out of the Woods Yet

- Saltmarsh Hosts 'Building Confidence': A Women-Focused Event Series

- The Power of Compounding in Health and Wealth

- Exciting Returns May Not Be Expected Returns

- The Dos and Don'ts of Credit Cards: How to Use Them Wisely

- Dimensional Fixed Income Trading: Price Is Our Priority

- Magnificent 7 Outperformance May Not Continue

- View All Articles