Election Years & Their Impact on the Market: A Data-Driven Perspective

10/22/2024 - By Chris Stennett, CFP

As the November election approaches, it's normal for investors to become anxious about how the outcome may impact their investments. The president wields tremendous power, so it’s reasonable to assume that the election of a particular party or candidate will have a direct and significant effect on the stock market. While this is an understandable conclusion, it is not correct. In this article, we'll explore election year market trends from 1928 to 2023, to illustrate why sticking to your investment strategy is the best approach, regardless of election results.

What the Data Tells Us: 1928–2023

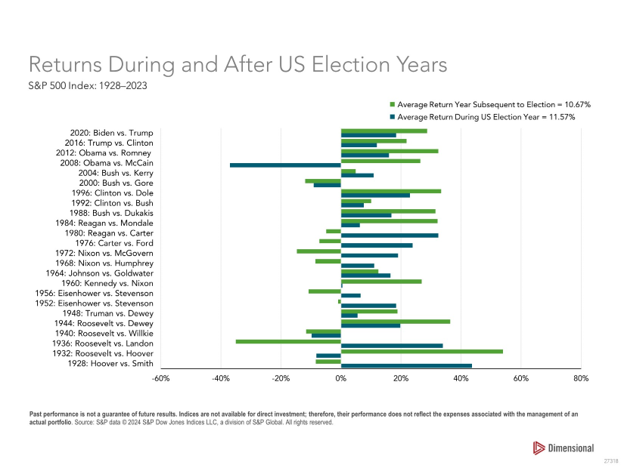

The chart below illustrates the actual return of every election year (Blue) and the year after (Green).

Key Insights:

- Average Return During U.S. Election Years (1928–2023): 11.57%. This is a solid return, even during the uncertainty of election years. The year-to-date return in 2024 is already an impressive 20.6% through the end of the 3rd quarter, demonstrating that election cycles don't inherently spell doom for markets.

- Average Return in the Year Following Elections: Historically, the average return of the S&P 500 the year after an election is 10.67%, irrespective of which party wins. Why is this important? New regimes elected in November don’t officially take office until the following calendar year, so current-year returns aren’t reflective of the new administration’s policies. By looking at the returns in the year after an election, investors get a better idea of how the market responded to the new leadership.

- Average Return Across All Presidential Terms: 9.5%. Over time, the market has produced positive returns during a wide variety of political administrations.

- Notable Terms with Negative Returns: Negative market returns have occurred under different political leaderships, including Bush (Rep. 2005–2008 and 2001–2004), Roosevelt (Dem.1937–1940), and Hoover (Rep. 1929–1932). Yet, these periods of decline were influenced by broader economic conditions, such as recessions and global crises, rather than solely by who was in office.

- Election Month Returns: Stock market data dating back to 1926 shows that returns during the month when a presidential election was held were not significantly different from those in other months. This further reinforces that election-related volatility is often overestimated.

Why Elections Don’t Typically Affect Stock Prices

Owning stocks means owning part of a company, and the primary focus of companies is to grow their business and deliver value to shareholders. This goal remains constant, regardless of who is in the White House.

Additionally, as information about tax policies, regulations, and other potential political outcomes becomes clearer, this information is quickly absorbed into stock prices. Market participants, including large institutional investors, buy or sell based on this new information, which causes prices to adjust accordingly. By the time election results are official, much of the market has already "priced in" any political changes, making sudden reactions less necessary.

Presidents may influence specific sectors—such as energy, healthcare, or defense—but predicting which way markets will move based solely on election outcomes has proven to be highly unreliable. Ultimately, markets are driven by a wide range of factors including global economic conditions, corporate earnings, and interest rates, none of which are controlled exclusively by political parties.

Stick to Your Long-Term Plan

It is extremely difficult to identify consistent patterns in election years that allow for reliably predicting returns above the market. Data from almost a century shows that, while elections may create short-term uncertainty, the long-term trajectory of markets remains positive across administrations of both parties. Because of this, our advice on the best course of action for most investors is to stick to their long-term plan. Remember, successful investing is built on patience, discipline, and a commitment to your investment strategy — regardless of political outcomes. If you're unsure about your strategy or don’t have one, consult with one of our financial advisors.

About the Author | Chris Stennett, CFP®

Chris is a senior financial advisor and Certified Financial Planner® practitioner for Saltmarsh Financial Advisors, LLC, an affiliate of Saltmarsh, Cleaveland & Gund. He serves individuals and organizations as a comprehensive financial planner and coordinator of investment activities. His areas of expertise include investment management, income planning, tax and estate planning, and risk management. Chris has over 15 years of experience as a wealth manager working with high-net-worth families and privately held business owners across the U.S.

Related Posts

- Alphabet Soup of Estate Planning

- Tariff Trepidation

- It's More Than 'Just a Phase'

- How to Avoid Black Swans

- An Investing Plan for This Year

- Demystifying Personal Injury Settlements: A Guide to Navigating Your Claim

- Reality Check: Capital Market Assumptions vs. Actual Returns

- The Power of Human Ingenuity

- 2024 Year in Review

- Feeling Generous? Secure Your Own Financial Well-Being First!

- Election Years & Their Impact on the Market: A Data-Driven Perspective

- The Unwinding of the Yen "Carry" Trade

- Preventing Identity Theft: Tips to Protect Yourself & Your Family

- Saltmarsh Financial Advisors Recognized as Top Wealth Advisory Firm by Accounting Today

- Father's Day: Money Lessons Learned From Dad

- What is Dollar Cost Averaging?

- Cost of Capital: A Gut Check on High-Flying Stock Returns

- A Closer Look at Today's Inflation (2024 Edition): Not Out of the Woods Yet

- Saltmarsh Hosts 'Building Confidence': A Women-Focused Event Series

- The Power of Compounding in Health and Wealth

- Exciting Returns May Not Be Expected Returns

- The Dos and Don'ts of Credit Cards: How to Use Them Wisely

- Dimensional Fixed Income Trading: Price Is Our Priority

- Magnificent 7 Outperformance May Not Continue

- Many Happy Returns

- View All Articles