Dimensional Fixed Income Trading: Price Is Our Priority

2/26/2024 - By Dimensional Fund Advisors

Trade executions prioritize among three key parameters: price, quantity, and timing. Dimensional’s top trading priority is price. It is the focal point throughout our investment process, given that prices incorporate the aggregate views of market participants, and that differences in prices have significant explanatory power for differences in expected returns. In fixed income, we use current market prices to calculate expected returns, to determine the most attractive term, credit, and currency positioning, and to monitor credit quality in real time. Our fixed income trading process has also been designed with the goal of realizing competitive pricing to help lower transaction costs and to potentially capture the targeted return premiums.

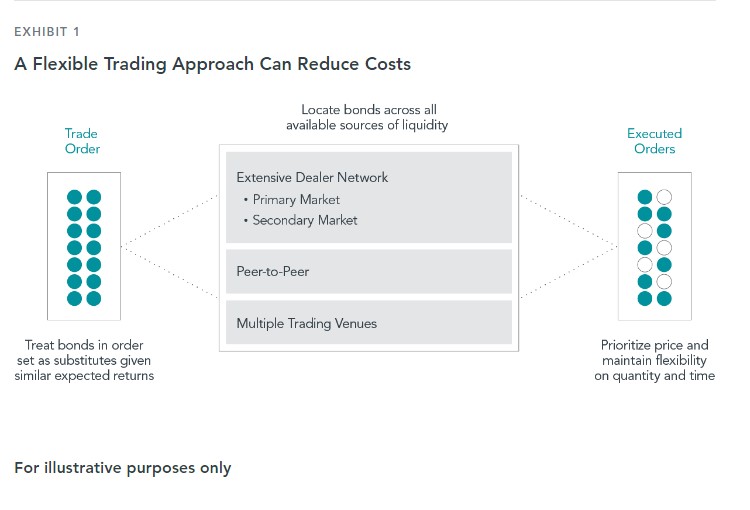

As illustrated in Exhibit 1, our market-based philosophy enables substitutability—we view bonds with similar characteristics as having similar expected returns. That, in turn, gives us flexibility in which bonds we buy or sell, allowing us to consider bonds with similar duration, credit, and currency characteristics as substitutes for one another. Afforded with this flexibility, we put trade orders into competition by using electronic trading platforms to reach all available counterparties and seek multiple bids or offers for bonds. The goal is to drive price competition for our trades across market participants. Our traders then evaluate prices received and can choose to execute or pass on any trade. To make this determination, we use comprehensive pricing data, including recent trade prices via TRACE and TraX, dealer inventories and quotes, pricing service streams, and market movement in credit default swaps and equity prices.

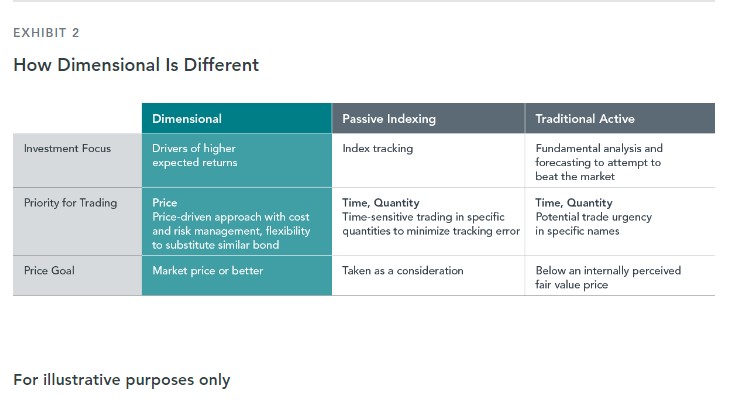

Our ability to put price first may result in a relative price advantage compared to other market participants, as Exhibit 2 shows. A traditional active bond manager may prioritize timing and quantity to execute quickly and take advantage of a perceived temporary mispricing. An index bond manager may also prioritize timing and quantity to minimize tracking error. In both scenarios, price is not the top priority.

Our ability to put price first may result in a relative price advantage compared to other market participants, as Exhibit 2 shows. A traditional active bond manager may prioritize timing and quantity to execute quickly and take advantage of a perceived temporary mispricing. An index bond manager may also prioritize timing and quantity to minimize tracking error. In both scenarios, price is not the top priority.

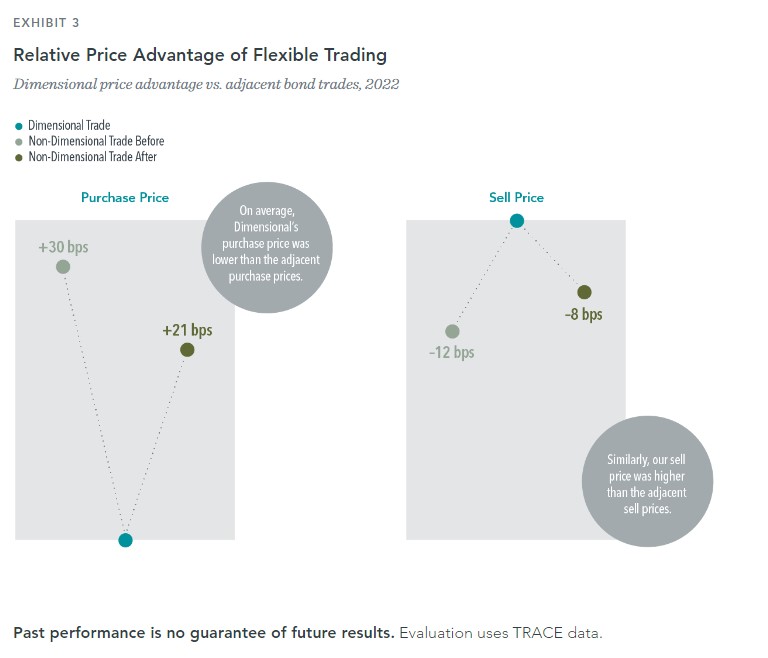

We systematically compare our executed trades to market trades reported through TRACE and find that our approach, on average, has historically resulted in favorable execution. On average, we paid less for bonds than other market participants paid buying the same bond immediately before and after us. Similarly, on average, we sold bonds for more than the adjacent market sale both preceding and following ours. While we theoretically have some control over our trading price relative to the prior reported trade, we have no control over the execution that occurs after our trade. We believe our ability to secure better execution on average than the trades that follow ours underscores the potential price advantages of our flexible trading approach, as demonstrated in Exhibit 3.

"Dimensional” refers to Dimensional Fund Advisors LP.

Source: TRACE. The Trade Reporting and Compliance Engine (TRACE) is the Financial Industry Regulatory Authority, Inc. (FINRA) developed vehicle that facilitates the mandatory reporting of over-the-counter secondary market transactions in eligible fixed income securities. bps (basis point): One hundredth of a percentage point (0.01%). Data compiled by Dimensional. TRACE-eligible corporate and agency bond trades from January 1, 2022 to December 31, 2022. Comparative trades (prior and post) are not filtered on trade size. This could have a considerable effect on the relative trade prices

By prioritizing price on bond transactions, our trading team helps realize the premiums our portfolio managers pursue daily, improving potential returns for our clients.

GLOSSARY

Basis Point (bp): One basis point equals 0.01%.

Credit default swaps: A form of insurance against the default of an issuer. The cost of that insurance generally increases when an issuer’s business and financial risk profiles deteriorate.

Primary market: A market where new securities are issued and sold for the first time.

Secondary market: A market where previously issued securities are traded by investors.

Peer-to-peer trading: The buying or selling of securities directly between investors with no intermediary transaction and is often done though an online trading platform.

Tracking error: The standard deviation of the difference in returns between two portfolios, one of which is typically a benchmark. Essentially, tracking error provides a measure of how much a portfolio deviates from its benchmark.

TRACE: TRACE is the Trade Reporting and Compliance Engine system. It was developed by the Financial Industry Regulatory Authority (FINRA) in 2002 to facilitate the mandatory reporting of over-the-counter secondary transactions in eligible fixed income securities. All broker-dealers that are FINRA members must report data on certain transactions within 15 minutes of trade execution.

TraX: A European fixed income market post-trade data reporting service provided by MarketAxess.

Related Posts

- Alphabet Soup of Estate Planning

- Tariff Trepidation

- It's More Than 'Just a Phase'

- How to Avoid Black Swans

- An Investing Plan for This Year

- Demystifying Personal Injury Settlements: A Guide to Navigating Your Claim

- Reality Check: Capital Market Assumptions vs. Actual Returns

- The Power of Human Ingenuity

- 2024 Year in Review

- Feeling Generous? Secure Your Own Financial Well-Being First!

- Election Years & Their Impact on the Market: A Data-Driven Perspective

- The Unwinding of the Yen "Carry" Trade

- Preventing Identity Theft: Tips to Protect Yourself & Your Family

- Saltmarsh Financial Advisors Recognized as Top Wealth Advisory Firm by Accounting Today

- Father's Day: Money Lessons Learned From Dad

- What is Dollar Cost Averaging?

- Cost of Capital: A Gut Check on High-Flying Stock Returns

- A Closer Look at Today's Inflation (2024 Edition): Not Out of the Woods Yet

- Saltmarsh Hosts 'Building Confidence': A Women-Focused Event Series

- The Power of Compounding in Health and Wealth

- Exciting Returns May Not Be Expected Returns

- The Dos and Don'ts of Credit Cards: How to Use Them Wisely

- Dimensional Fixed Income Trading: Price Is Our Priority

- Magnificent 7 Outperformance May Not Continue

- Many Happy Returns

- View All Articles