What's New? CFPB Releases New Five Year Strategic Plan

3/8/2018 - By Sarah Oliver, CRCM

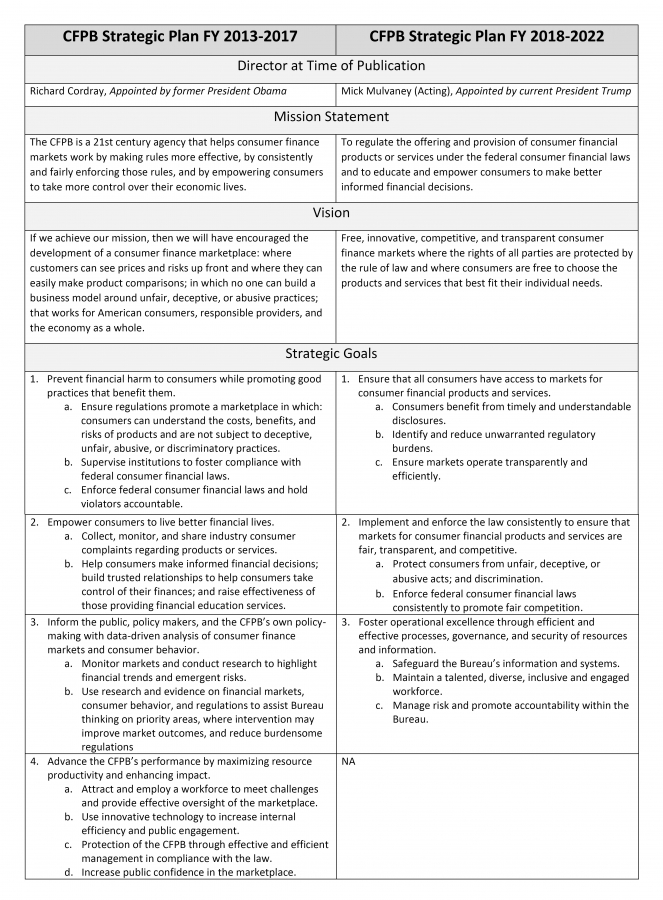

On February 12, 2018 the Consumer Financial Protection Bureau (CFPB) released its Strategic Plan for FY 2018-2022. A lot has changed since the first five-year Strategic Plan for FY 2013-2017 was published.

Regardless of how small your institution may be, all institutions are affected by the actions and the direction of the CFPB. Although small banks and credit unions may not be directly supervised by the CFPB, they still are subject to the federal financial consumer protection laws the agency oversees. The CFPB has immense power in that it has the authority to enforce and make revisions to existing regulations, as well as promulgate new ones.

In keeping with simplicity, I developed a comparison chart that you may use to draw your own conclusions (and inform your CEO) which direction the CFPB appears to be taking. Statements by new acting director Mick Mulvaney such as “we have committed to fulfill the Bureau’s statutory responsibilities but go no further” and vowing against misuse of the bureau’s “unparalleled powers” are promising. It seems that the ‘new’ CFPB plans to take a more reasonable approach to rulemaking and enforcement.

Despite the promising outlook for the industry, don’t let your guard down and do continue your current vigilance in providing products and services designed to suit the individual consumer’s needs. It is not only good for the consumers, but it’s good for your financial institution. In my own experience, nothing feels better than always doing the next right thing.

About the Author | Sarah Oliver, CRCM

Sarah is a consultant in the Financial Institutions Advisory Group of Saltmarsh, Cleaveland & Gund. Her primary areas of expertise include providing compliance reviews, assisting with special research matters and consulting on deposit and lending related regulations as well as social media approaches for financial institutions.

Related Posts

- The Future of ACH Compliance: Insights on Nacha's Latest Rules

- Regulation CC Update Summary

- Saltmarsh Strenghthens Fair Lending Services

- From the Asset-Liability Management Trenches: A Focus on Liquidity 2024

- Unlocking the Power of ACH Compliance Reviews: Requirements and Benefits for Third-Party Senders and Service Providers

- Safeguarding Against ACH Fraud: Ten Essential Steps for Financial Institutions and Businesses

- ICYMI: An Important Reminder About the CRA Public File, and More

- Understanding ACH Risk Assessments: A Crucial Requirement of the Nacha Rules

- Nacha's Updated Written Statement of Unauthorized Debit: Should You Update Your WSUD Forms?

- Saltmarsh Hosts 18th Annual BankTalk

- Jay Newsome Joins Financial Institution Consulting Group & Expands Firm's Alabama Market Presence

- Best Practice Ideas from the Asset-Liability Management Trenches

- Managing Risk: Fraud Deterrence Is Always a Priority

- Webinar on Demand: Getting to Know FedNow, Now

- Nacha's 2023 Rules Updates: Are You Affected?

- Do I Need an ACH Audit?

- Webinar Recording: Top 8 ACH Audit Findings You Should Be Aware Of

- Think CECL Is Only for Banks? Not So Fast!

- Saltmarsh Hosts 17th Annual Community BankTalk Event

- Preparing for $500 Million in Assets

- Secure Exchange of Standardized Letters of Indemnity

- Best Practice Suggestions for Back-Testing Asset-Liability Management (ALM) Models for Accuracy

- Words to Live By

- Webinar Materials: The New ACH Rules on Micro-Entries

- Nacha Micro Entry-Rule

- View All Articles