Cares Act vs American Rescue Plan Act Funding

6/25/2021 - By Saltmarsh, Cleaveland & Gund

With the enactment of the Coronavirus State Fiscal Recovery Fund and the Coronavirus Local Fiscal Recovery Fund (Coronavirus Recovery Fund) established under the American Rescue Plan Act (ARPA) on May 10, 2021, the U.S. Department of the Treasury has made available $350 Billion to state and local governments to cover the costs incurred as a result of recovery efforts related to the COVID-19 pandemic. The initial dispersal of these funds will begin taking place in July 2021, with a second dispersal of an equal amount taking place in mid-2022. This follows the distribution of $150 Billion to state and local governments through the Coronavirus Relief Fund (CRF) as established under the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), which took place throughout 2020 and early 2021.

Although these two funding streams are similar in their aim of enabling state, territorial, tribal, county, metropolitan city and other local governments to assist their communities as they recover from the pandemic, the types of eligible costs and applicability of the two funds are quite different. It is important for civic leaders to understand the difference between the two funding streams, to ensure that their communities are able to make best use of the grant allocations.

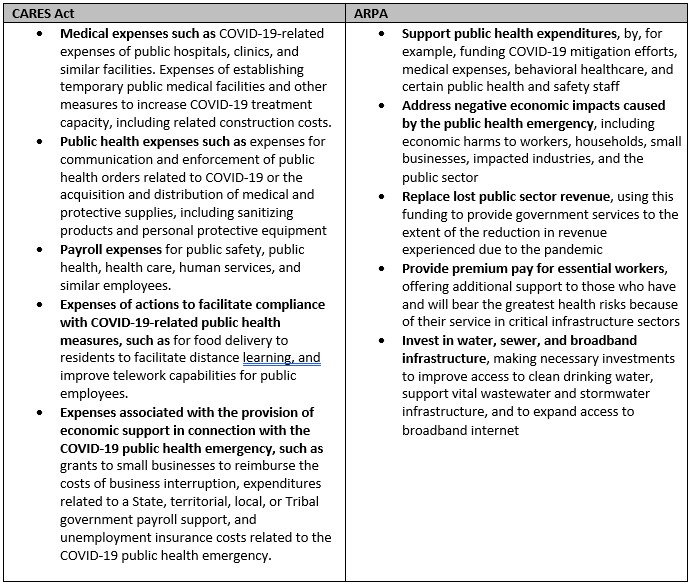

CARES Act funding is eligible to be utilized for necessary expenditures incurred due to the public health emergency. The eligible expenditures include those costs incurred:

- In direct response to the emergency, such as by addressing medical or public health needs

- To respond to second-order effects of the emergency, such as by providing economic support to those suffering from employment or business interruptions due to COVID-19-related business closures.

ARP Act funding is eligible to be utilized to meet pandemic response needs and rebuild a stronger, and more equitable economy as the country recovers. The eligible expenditures include those costs incurred:

- To provide support for households, small businesses, impacted industries, essential workers, and the communities hardest hit by the crisis

- To make necessary investments in water, sewer, and broadband infrastructure

It should be noted that those ongoing expenditures claimed under the CARES Act, which are now also eligible under ARPA can continue to be considered for reimbursement and funding. However, it should be noted that there are three major exceptions to this rule: ARPA places additional restrictions on payroll costs for public health and safety employees, does not allow expenses related to issuing tax-anticipation notes, and are not eligible to be utilized for non-federal matching requirements such as FEMA Disaster Assistance or Medicaid.

In addition to the differentiation in expenditure eligibility, there are some variations in the cost accounting and performance period between CARES and ARPA funds.

To comply with federal requirements, recipients of CARES and ARP funds may need to change their internal control structure, which can be a complex endeavor. From adhering to Uniform Guidance to following the “Internal Control Integrated Framework” issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), creating, implementing, and documenting an internal control system for grants requires a considerable amount time and manpower.

Questions?

If you have any questions, contact our COVID-19 response team, or go to our COVID-19 resource hub for more information!

Related Posts

- Are there State Tax Liabilities for Employers if Employees Work from Home?

- Webinar Materials: Rethinking Financial Reporting - Nonprofit Strategy

- Webinar Materials: New Mortgage Servicing Rules

- Cryptocurrency - It's Time to Acknowledge the Elephant in the Room

- WEBINAR MATERIALS: PRF Reporting Update for Healthcare

- What's New with the Employee Retention Credit: An Overview

- White Paper: Manufacturing Outlook, Lean Thinking to Reduce Costs

- Higher Education in the U.S. - Rising Costs, Enrollment Challenges and the Need for Innovative Solutions

- WEBINAR MATERIALS: Current Update on CARES Act PRF Reporting Instructions & Recent FAQs

- 2021 State & Local Tax Year-End Issues to Consider Now

- The Sky Is Not Falling... Yet

- Cares Act vs American Rescue Plan Act Funding

- GovCon Updates of the Week Part 10

- Covid-19 Implications For Presumptive Laws And Workers' Compensation

- Asset Liability Management Modeling in a COVID-19 World

- Maximizing Value and Minimizing Risk in Your Managed Care Contract Portfolio

- The Excess Liquidity Puzzle

- Finding Flexibility Amid COVID-19: How Nonprofits Can Scale for Success

- White House Unveils Plan to Help American Families Funded by Tax Increases on Wealthy

- Tech Leaders Worldwide Have Optimistic Outlook For 2021

- White Paper: Manufacturing Outlook, Help Wanted

- Employer Tax Credit for Vaccine-Related Sick Leave

- GovCon Updates of the Week Part 5

- IRS Issues Guidance for Claiming Employee Retention Credit in 2021

- Five Metrics Your Construction Company Should Start Tracking Today

- View All Articles