2020 Year-End Tax Planning Highlights for Individuals

11/2/2020 - By David Uslan, CPA

As the year-end approaches, individuals should be reviewing their situations to identify any opportunities for reducing, deferring or accelerating tax obligations. Areas that should be looked at in particular include tax reform provisions that remain in play, as well as new opportunities and relief granted earlier in 2020 under the CARES and SECURE Acts. This article highlights specific areas and provides preliminary inflationary adjustment items for 2021 as of October 15, 2020, compared to current 2020 amounts, to aid taxpayers as they plan deferrals and accelerations before year-end (anticipated inflationary adjustments provided by Thomson Reuters Checkpoint and Bloomberg Tax & Accounting are used; official numbers have not yet been published by the IRS, but are expected to be made available later in 2020).

A discussion about 2020 year-end tax planning likely should involve a discussion about the U.S. presidential election. To date, neither candidate has released a formal plan regarding the tax code. Taxpayers can still make informed decisions by taking into consideration what the candidates have said about tax policy on the campaign trail. Of note, Joe Biden has spoken to:

- Raising the top individual income tax rate to 39.6%

- Raising the tax on capital gains at 39.6% for taxpayers with more than $1,000,000 in income

- Eliminating step-up of basis at death

Individual’s Tax Planning Highlights

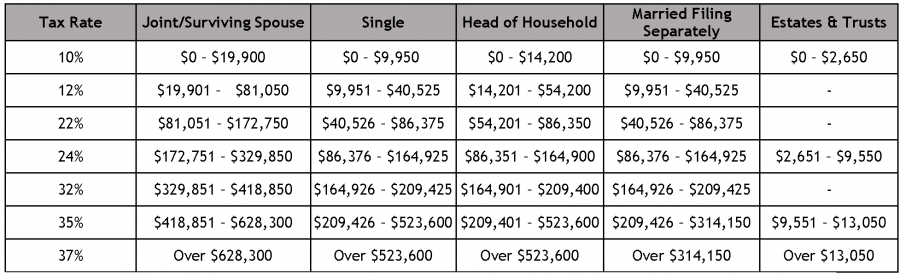

2020 Federal Income Tax Rate Brackets

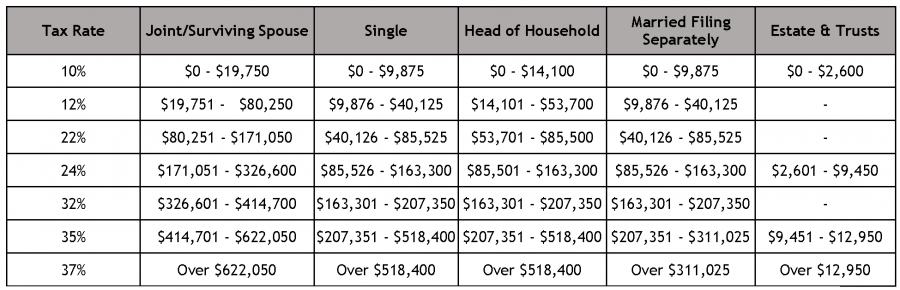

Projected 2021 Federal Income Tax Rate Brackets

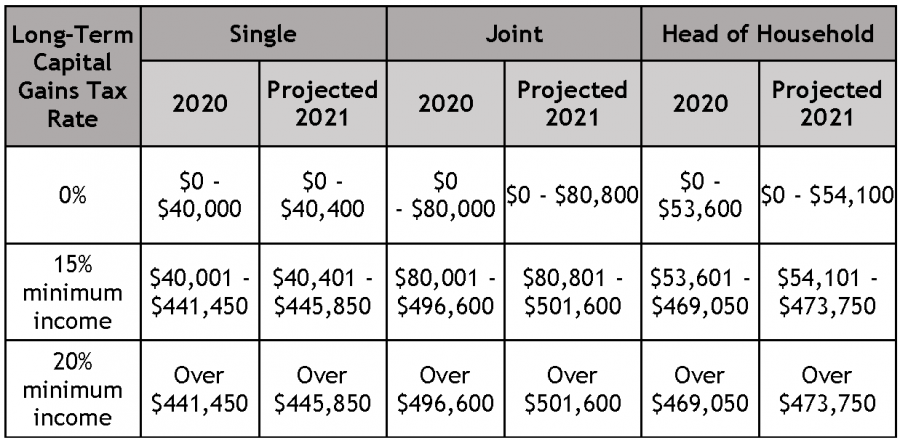

Long-Term Capital Gains

- The brackets for long-term capital gains for 2020 and the projected 2021 rates are shown below. Long-term capital gains are subject to a lower tax rate, so investors may wish to consider holding on to assets for over a year to qualify for those rates.

Social Security Tax

- The Old-Age, Survivors, and Disability Insurance (OASDI) portion of the social security tax is imposed on employee compensation and self-employment income, but only to the extent of the maximum wage base set by the Social Security Administration ($137,700 for 2020 and $142,800 for 2021 by the Social Security Administration).

- The OASDI program is funded by contributions from employees and employers through FICA tax. The FICA tax rate for both employees and employers is 6.2% of the employee's gross pay. Self-employed persons pay a similar tax, called SECA (or self-employment tax), based on 12.4% of the net income of their businesses.

- On August 8, 2020, President Trump issued an executive order allowing employers to defer the withholding, deposit and payment of certain employee payroll taxes from September 1 to December 31, 2020. Further guidance is contained under Notice 2020-65.

- Employers, employees and self-employed persons also pay a tax for Medicare/Medicaid hospitalization insurance (HI), which is part of the FICA tax, but is not capped by the OASDI wage base. The HI payroll tax is 2.9%, which applies to earned income only. Self-employed persons pay the full amount, while employers and employees each pay 1.45%.

- Some high earners must pay an extra 0.9% HI payroll tax on earned income that is above certain adjusted gross income (AGI) thresholds, i.e., $200,000 for individuals, $250,000 for married couples filing jointly and $125,000 for married couples filing separately in 2020. However, employers do not pay that extra tax. This tax, also known as the Additional Medicare Tax, was enacted as part of the Affordable Care Act (ACA). The constitutionality of the ACA has been challenged in California v. Texas, No. 19-840, which is set for oral arguments before the Supreme Court on November 10, 2020. Specifically, the issue before the Court is whether the ACA became unconstitutional when Congress reduced the individual mandate penalty to $0. The effective date of the penalty repeal was January 1, 2019. Accordingly, the Court’s ruling in California v. Texas could ultimately impact the Additional Medicare Tax.

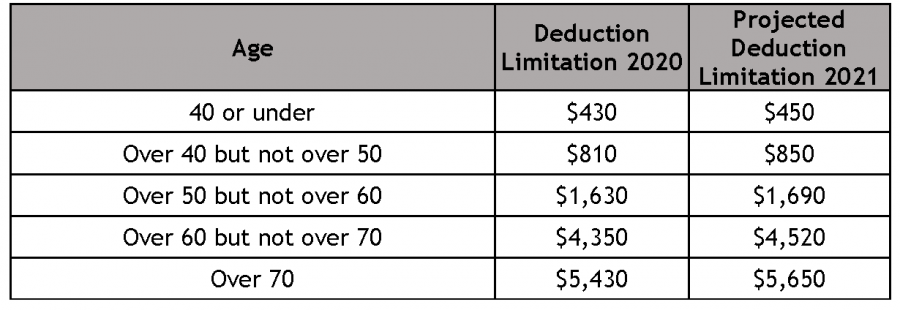

Long-Term Care Insurance & Services

- Premiums an individual pays on a qualified long-term care insurance policy are deductible as a medical expense. The maximum amount of a deduction is determined by an individual’s age. The following table sets forth the deductible limits for 2020 and 2021:

These limitations are per person, not per return. Thus, a married couple, both spouses over 70 years old, has a combined maximum deduction of $10,860 ($11,300 projected for 2021), subject to the applicable AGI limit.

Retirement Plan Contributions

- If an employer (including a tax-exempt organization) has a 401(k) plan or 403(b) plan, the maximum amount of elective contributions that employee can make in 2020 is $19,500 ($26,000 if age 50 or over and the plan allows “catch up” contributions, which allows an additional $6,500). For 2021, those limits are projected to remain the same. Qualified plan limits are based on the year-to-year increases in the third-quarter Consumer Price Index for All Urban Consumers (CPI-U), so those amounts cannot be finalized until after the September CPI-U values are published in October. The IRS is expected to announce the official 2021 limits in late October or early November.

- The SECURE Act permits a penalty-free withdrawal of up to $5,000 from traditional IRAs and qualified retirement plans for expenses related to the birth or adoption of a child after December 31, 2019. To qualify, the distribution must be made during the one-year period beginning on the date the child is born or the adoption is finalized. Eligible adoptees are any individual who has not reached age 18 or is physically or mentally incapable of self-support. Qualified birth or adoption distributions are included in the taxpayer’s income in the year of withdrawal but are not subject to the 10% early withdrawal penalty or to the mandatory 20% tax withholding and may be repaid to the retirement plan at any time. The $5,000 distribution limit is per individual, so a married couple could each receive $5,000.

- Previously, individuals were not able to contribute to their traditional IRAs in or after the year in which they turn 70½. The SECURE Act eliminates this age cap.

- The SECURE Act changes the age for required minimum distributions (RMDs) from tax-qualified retirement plans and IRAs from age 70½ to age 72 for individuals born on or after July 1, 1949. Generally, the first RMD for individuals who were born on July 1, 1949, or later is due by April 1 of the year after the year in which they turn 72.

- The SECURE Act generally requires that designated beneficiaries of persons who die after December 31, 2019, take inherited plan benefits over a 10-year period. Eligible designated beneficiaries (i.e., surviving spouses, minor children of the plan participant, disabled and chronically ill beneficiaries and beneficiaries who are less than 10 years younger than the plan participant) are not subject to this rule. Conduit trusts and see-through accumulation trusts are required to use the 10-year payout rule unless the trust is for the sole benefit of a disabled or chronically ill beneficiary. Non-see-through accumulation trusts will continue to use the five-year payout period, which was required before the SECURE Act.

- The CARES Act allows eligible individuals to withdraw up to $100,000 from qualified retirement plans during 2020 without incurring the 10% early distribution penalty. Individuals or their spouses, dependents or other household members affected by COVID-19 may qualify for this relief. Such taxable distributions can be included in gross income ratably over three years. Taxpayers may recontribute the withdrawn amounts to a tax-qualified plan or IRA at any time within three years after the distribution. These repayments will be treated as a tax-free rollover and are not subject to that year’s cap on contributions.

Foreign Earned Income Exclusion

- The foreign earned income exclusion is $107,600 in 2020, projected to increase to $108,700 in 2021.

Alternative Minimum Tax

- A taxpayer must pay either the regular income tax or the alternative minimum tax, whichever is higher. The established exemption amounts for 2020 are $72,900 for unmarried individuals and individuals claiming head of household status, $113,400 for married individuals filing jointly and surviving spouses, and $56,700 for married individuals filing separately. For 2021, those amounts are projected to increase to $73,600 for unmarried individuals and individuals claiming the head of household status, $114,600 for married individuals filing jointly and surviving spouses, and $57,300 for married individuals filing separately.

Kiddie Tax

- The SECURE Act reinstates the kiddie tax previously suspended by the Tax Cuts and Jobs Act (TCJA). For tax years beginning after December 31, 2019, the unearned income of a child is no longer taxed at the same rates as estates and trusts. Instead, the unearned income of a child will be taxed at the parents’ tax rates if those rates are higher than the child’s tax rate. Taxpayers can elect to apply this provision retroactively to tax years that begin in 2018 or 2019 by filing an amended return.

Charitable Contributions

- Currently, individuals who make cash contributions to publicly supported charities are permitted a charitable contribution deduction of up to 60% of their AGI. Contributions in excess of the 60% AGI limitation may be carried forward in each of the succeeding five years. The CARES Act suspends the AGI limitation for qualifying cash contributions and instead permits individual taxpayers to take a charitable contribution deduction for qualifying cash contributions made in 2020 to the extent such contributions do not exceed the taxpayer’s AGI. Any excess carries forward as a charitable contribution that is usable in the succeeding five years. Contributions to non-operating private foundations or donor-advised funds are not eligible for the 100% AGI limitation.

Estate and Gift Taxes

- The unified estate and gift tax exclusion and generation-skipping transfer tax exemption is $11,580,000 per person in 2020. For 2021, the exemption is projected to increase to $11,700,000.

- All outright gifts to a spouse who is a U.S. citizen are free of federal gift tax. However, for 2020 and 2021, only the first $157,000 and $159,000 (projected), respectively, of gifts to a non-U.S. citizen spouse are excluded from the total amount of taxable gifts for the year.

Simplified Employment Pension Plans

- Small businesses can contribute up to 25% of employees’ salaries (up to an annual maximum set by the IRS each year) to a Simplified Employee Pension (SEP) plan. The SEP contribution must be made by the extended due date of the employer’s federal income tax return for the year that the contribution is made. The maximum SEP contribution for 2020 was $57,000. The maximum SEP contribution for 2021 is projected to be $58,000.

- The calculation of the 25% limit for self-employed individuals is based on net self-employment income, which is calculated after the reduction in income from the SEP contribution (as well as for other things, such as self-employment taxes).

Net Operating Losses

- Under the TCJA, net operating losses generated beginning in 2018 were limited to 80% of taxable income and could not be carried back but could be carried forward indefinitely. The CARES Act permits individuals with net operating losses generated in taxable years beginning after December 31, 2017, and before January 1, 2021, to carry those losses back five taxable years. The CARES Act also eliminates the 80% limitation on such losses.

Excess Business Loss Limitation

- Under Section 461(l), a taxpayer will only be able to deduct net business losses of up to $262,000 (projected) in 2021 (joint filers can deduct $524,000 (projected) in 2021) for taxable years beginning after December 31, 2020, and before January 1, 2026. Excess business losses are normally disallowed and added to the taxpayer’s net operating loss carryforward, but the CARES Act suspends the application of this excess business loss rule for 2020, and retroactively suspends the excess business loss limitation rule for 2018 and 2019.

The information contained within this article is summarized. Taxpayers should consult their trusted advisor when making tax and financial decisions regarding any of the items mentioned.

If you have questions or would like additional information, please contact a member of our Tax Consulting team or call your Saltmarsh tax advisor at (800) 477-7458.

Download the 2020 Year-End Tax

Planning Highlights for Individuals

Related Posts

- Alphabet Soup of Estate Planning

- Mastering the Tax Tango

- Tax Alert: Beneficial Ownership Information (BOI) Reporting Requirement

- Choosing an Accountant: 5 Essential Tips for Business Owners

- Time Management Tips for Accountants: A Guide from Your Friendly Tax Operations Coordinator

- How the Supreme Court's Decision Regarding Life Insurance Proceeds Changes the Federal Estate Tax Landscape

- Estate Tax Alert: Exemption Being Reduced in 2026

- 5 Reasons Why Your Startup Needs an Accountant

- Saltmarsh Hosts 'Building Confidence': A Women-Focused Event Series

- Tax Alert: New DOL Guidance on Employee or Independent Contractor Classification

- Saltmarsh Awarded 2024 Best of Accounting

- Tax Alert: New Electronic Filing Rules for W-2s and 1099s

- Employee Retention Credit (ERC) Update: Everything You Need to Know About the ERC Moratorium

- Navigating the Corporate Transparency Act: A Practical First Look for Business Owners

- Employee (W2) vs Contractor (1099)

- The Employee Retention Credit: What Taxpayers Need to Know

- Understanding Tax-Related Identity Theft

- 5 Essential Documents for Your Estate Plan

- Are you Prepared For Changes to Estate Tax Exemptions?

- 4 Painless Ways to Achieve Financial Security

- NIL (Name, Image, Likeness): Income Tax Considerations for Student-Athletes

- Natural Disaster Casualty Losses

- Inflation Reduction Act of 2022

- Estate Planning with a Revocable Trust: A Case Study

- State and Local Tax: Basics to Consider

- View All Articles