Unrealized Losses in Securities Portfolios: Can We Stop the Bleeding?

4/13/2022 - By Joshua Jackson, CPA

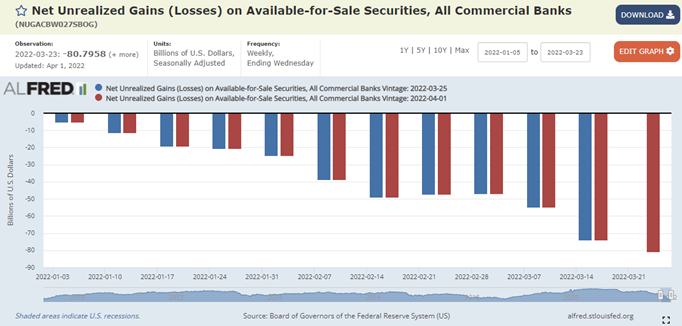

Over the last three months, unrealized losses in available-for-sale (AFS) securities portfolios have accelerated at a staggering rate. The graph below illustrates the remarkable downward trend in valuations since January 2022.

Unrealized losses in AFS portfolios across the banking industry are at their highest levels since July 2009, and likely from even earlier, as shown below.

What can portfolio managers do to curtail these unfavorable changes to capital composition?

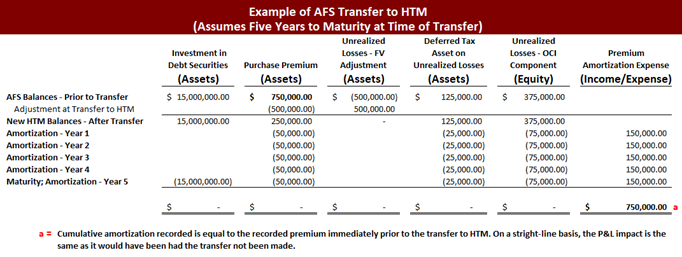

Of course, smaller institutions can make the “AOCI opt-out” election for calculating regulatory capital ratios, but let’s be honest, nobody likes to see a large and growing debit balance sitting in their equity accounts. As a community banker recently asked, “How can we stop the bleeding?” One option being explored more frequently today is the transfer of AFS securities into the held-to-maturity (“HTM”) category. Of course, this option does not immediately eliminate the other comprehensive income (“OCI”) component of unrealized losses from equity, but it does “stop the bleeding”, so to speak. A simplified example of such a transfer follows below, which assumes a remaining maturity term of five years on securities transferred and no principal paydowns.

General Accounting Framework

Essentially, unrealized losses formerly recorded as fair value adjustments to amortized cost are transferred to and netted against the unamortized purchase premiums (or discounts) at the time of transfer resulting in a new premium (or discount) balance, consistent with ASC 320-10-35-10. In addition, the deferred tax assets arising from unrealized losses, as well as the OCI component in equity, become frozen at the time securities are transferred. These items, along with the new amount recorded as purchase premiums, are amortized over the remaining lives of transferred securities in a manner consistent with the amortization of any premium or discount. Keep in mind that amortization will not necessarily be on a straight-line basis for certain asset-backed securities with principal paydowns, as prepayment speeds, interest rates and other factors affecting asset lives can change rapidly.

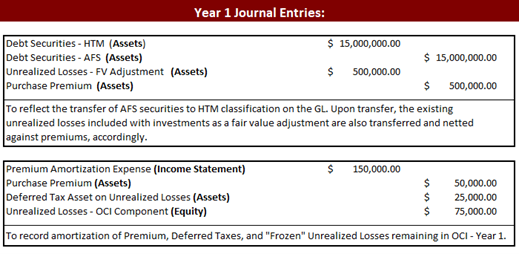

Below are examples of journal entries that would be made in Year 1 of the transfer scenario presented above:

Unrealized Losses on the Radar

As previously mentioned, this topic is gaining traction in management discussions and strategic sessions at many institutions. If this type of classification change is an option your team is currently evaluating, a few quick summary points to consider include the following:

- There is no additional impact to earnings caused by the transfer of securities from AFS to HTM, as the ending cumulative amount of amortization expense is equal to the amount that would have been recorded had the transfer not been made.

- As noted above, the unrealized loss position of the securities is not immediately eliminated from the balance sheet upon transfer, but it is amortized over the life of the securities in a manner consistent with the amortization of any related premium or discount as an adjustment of yield.

- Under current accounting guidance, entities cannot sell HTM securities or transfer HTM securities back to the AFS classification without “tainting the portfolio” unless certain criteria are met in accordance with ASC 320-10-25-6(a) through (f) and ASC 320-10-25-9(a) through (d). Consistent with the accounting standards, the FDIC issued guidance in its “Frequently Asked Questions for Financial Institutions Affected by the Coronavirus Disease 2019 (Referred to as COVID-19)” document that addresses this issue. Specifically, the FDIC guidance suggests financial institutions with strained or depleted liquidity levels due to COVID-19 may be able to sell securities classified as HTM without tainting the remaining portfolio or jeopardizing the ability to use the HTM classification in the future. However, institutions should consult with their auditors for further clarification and assistance in assessing the circumstances underlying the decision to sell HTM securities. Generally speaking, transfers from the HTM category should be rare. Once the transfer is made to HTM, that is typically where those securities should stay.

Questions?

At Saltmarsh, we understand the strategic challenges currently facing the financial institutions industry and our team stands ready to assist you in navigating these uncertain times. If you have any specific needs, or simply need to use us as a sounding board, please do not hesitate to contact a member of our Financial Institutions team.

About the Author | Josh Jackson, CPA

Josh is a senior manager in the Financial Institution Advisory Group of Saltmarsh, Cleaveland & Gund. He has over 18 years of public accounting and financial services experience, primarily serving financial institutions. Josh has extensive experience in delivering accounting services, external audits, directors’ examinations and agreed-upon procedures, loan and credit quality reviews, internal audits, due diligence projects related to mergers and acquisitions, and other consulting services. Prior to rejoining Saltmarsh in 2020, Josh served in various management roles in private industry, including the role of Chief Financial Officer.

Related Posts

- Saltmarsh Strenghthens Fair Lending Services

- From the Asset-Liability Management Trenches: A Focus on Liquidity 2024

- Unlocking the Power of ACH Compliance Reviews: Requirements and Benefits for Third-Party Senders and Service Providers

- Safeguarding Against ACH Fraud: Ten Essential Steps for Financial Institutions and Businesses

- ICYMI: An Important Reminder About the CRA Public File, and More

- Understanding ACH Risk Assessments: A Crucial Requirement of the Nacha Rules

- Nacha's Updated Written Statement of Unauthorized Debit: Should You Update Your WSUD Forms?

- Saltmarsh Hosts 18th Annual BankTalk

- Jay Newsome Joins Financial Institution Consulting Group & Expands Firm's Alabama Market Presence

- Best Practice Ideas from the Asset-Liability Management Trenches

- Managing Risk: Fraud Deterrence Is Always a Priority

- Webinar on Demand: Getting to Know FedNow, Now

- Nacha's 2023 Rules Updates: Are You Affected?

- Do I Need an ACH Audit?

- Webinar Recording: Top 8 ACH Audit Findings You Should Be Aware Of

- Think CECL Is Only for Banks? Not So Fast!

- Saltmarsh Hosts 17th Annual Community BankTalk Event

- Preparing for $500 Million in Assets

- Secure Exchange of Standardized Letters of Indemnity

- Best Practice Suggestions for Back-Testing Asset-Liability Management (ALM) Models for Accuracy

- Words to Live By

- Webinar Materials: The New ACH Rules on Micro-Entries

- Nacha Micro Entry-Rule

- Elder Financial Exploitation by the Numbers

- CECL: What About Credit Losses on Debt Securities?

- View All Articles